Economical

Get fast and straightforward services wherever you are. A single document is all it takes

Get fast and straightforward services wherever you are. A single document is all it takes

Trust our direct lending with a new twist. Your data is secure, and we're there in difficult times

Simple solutions from home, fast. Instant money in your account and flexible loan terms

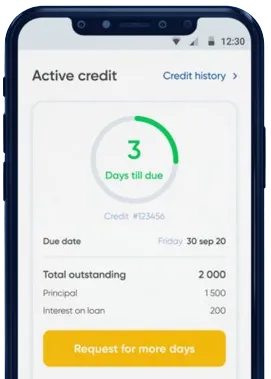

Submit an application via our app. Just fill out a simple form.

Stand by for our decision, usually delivered in just 15 minutes.

Secure your funds, generally processed in just one minute.

Submit an application via our app. Just fill out a simple form.

Download loan app

When unexpected expenses arise or emergencies occur, having access to a quick loan can be a lifesaver. In Nigeria, urgent loan 10,000 offers a convenient solution for individuals in need of immediate financial assistance.

One of the main advantages of urgent loan 10,000 in Nigeria is its speed and simplicity. With minimal documentation requirements and quick approval processes, borrowers can receive the funds they need in a timely manner.

Additionally, urgent loan 10,000 is accessible to a wide range of individuals, including those with no credit history or poor credit scores. This inclusive approach ensures that more people can access the funds they need during challenging times.

These benefits make urgent loan 10,000 a valuable resource for individuals facing financial emergencies or cash flow shortages.

Urgent loan 10,000 can be used for a variety of purposes, including covering medical expenses, paying utility bills, repairing a vehicle, or handling unexpected household repairs. The flexibility of these loans allows borrowers to address pressing financial needs without delay.

Furthermore, urgent loan 10,000 can provide peace of mind during challenging times, allowing individuals to focus on resolving their financial issues without worrying about where to find the necessary funds.

For individuals in Nigeria seeking a reliable and accessible financial solution, urgent loan 10,000 offers a dependable option. With its user-friendly application process, quick approval, and flexible repayment terms, this loan product stands out as a practical choice for those in need of immediate financial assistance.

By choosing urgent loan 10,000 in Nigeria, borrowers can benefit from a trustworthy and efficient lending service that prioritizes their financial well-being.

In conclusion, urgent loan 10,000 in Nigeria serves as a valuable resource for individuals facing unforeseen financial challenges. With its quick approval process, flexible repayment options, and inclusive approach, this loan product offers a practical solution for those in need of immediate financial assistance. By choosing urgent loan 10,000, borrowers can address their financial needs promptly and effectively, ensuring peace of mind during difficult times.

Yes, you can apply for an urgent loan of 10,000 in Nigeria through various lending institutions or online platforms.

The eligibility criteria may vary among lenders, but generally, you need to be a Nigerian citizen or resident, have a steady source of income, and meet the minimum age requirement (usually 18 years old).

The process of receiving the funds for an urgent loan of 10,000 in Nigeria can vary depending on the lender, but it typically takes 24 to 72 hours after approval.

The interest rate for an urgent loan of 10,000 can vary among lenders, but it is typically between 5% to 15% per month.

It is important to read the terms and conditions carefully before applying for an urgent loan of 10,000 to check for any hidden fees. Some lenders may charge processing fees or late payment fees.

Some lenders allow you to repay your urgent loan of 10,000 early without penalty, while others may charge a fee for early repayment. It is important to clarify this with the lender before taking out the loan.